fDi's Investors of the Year 2018: IWG takes Amazon's crown

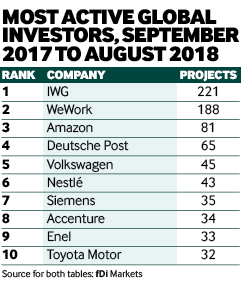

Global office providers International Workplace Group and WeWork have ranked as fDi Intelligence’s top investors of 2018, followed by Amazon. Naomi Davies reports.

Luxembourg-based International Workplace Group (IWG), the world’s biggest serviced office provider, is the top global investor of 2018, up from second place in 2017’s ranking. The company, formerly known as Regus, has pursued an aggressive expansion strategy as worldwide demand for flexible office space grows and competition from start-ups intensifies.

According to data from greenfield investment monitor fDi Markets, IWG created 221 projects between September 2017 and August 2018, an increase of 200% on the previous 12-month period.

Western Europe was the main destination market for the company, where it made 92 investments – more than double the amount from the previous period – followed by Asia-Pacific (42) and North America (39). IWG was also the top investor in emerging Europe and Africa. Almost two-thirds of these investments were made through the company’s subsidiary, Spaces, a high-end co-working firm founded in Amsterdam that IWG acquired in 2015.

IWG announced plans for major expansion in several countries throughout the 12-month period. This included plans to open 30 business centres in France, with branches in cities such as Reims, Mulhouse, Nancy and Metz. IWG also announced plans to open 15 new offices in Spain and six new locations in India.

IWG’s US-based rival WeWork, a shared-office start-up founded in 2010, is in second position, up from seventh in the previous ranking. The company, valued at $20bn by its backer Softbank, has also undergone an aggressive period of expansion around the world and has become the largest corporate occupier in London.

WeWork invested in 188 projects in the review period, up a staggering 420% from the same period in 2017. More than half (52%) of these were created in Asia-Pacific – the company’s key target market – followed by western Europe (45 projects) and Latin America and the Caribbean (35). The company was also named top regional investor in both Asia-Pacific and Latin America and the Caribbean. Investments in business services operations accounted for WeWork’s entire FDI activity between September 2017 and August 2018.

US-based online retail company Amazon, the Global Investor of the Year for both 2016 and 2017, falls to third in this year’s ranking. The company invested in 81 projects between September 2017 and August 2018, down 7% on the previous 12 months. Nearly 60% of these were logistics, distribution and transportation operations, while 15% were in design, development and testing. In March 2018, the company announced plans to open a new distribution centre at East Midlands Gateway in Castle Donnington, UK, which will see the creation of 3330 new jobs.

The Middle East is the only region where neither IWG nor WeWork are the top investor. Instead Kuwait-based Agility, a global logistics and freight company, takes the top spot.

In November 2017, the company announced plans to invest $1.2bn to establish a new shopping centre in Abu Dhabi as part of a joint venture with United Projects for Aviation Services Company and National Real Estate Company.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.