China named 2017’s fastest growing nation brand

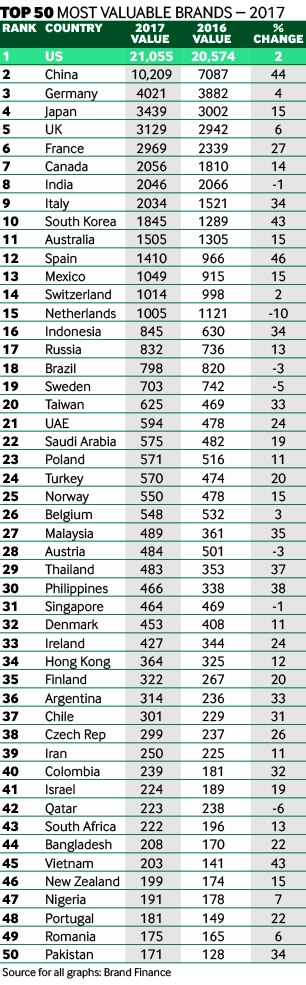

China’s national brand has increased significantly in 2017 at 44%, reflecting a general global dynamic where Asian countries are advancing while Western countries are stagnating.

China is fast closing the gap with the US when it comes to the prestige and value of its national brand. According to 2017’s annual Brand Finance Nation Brands study, China is the fastest growing nation brand this year in absolute terms, with a change of more than $3100bn year on year. This figure is equal to the entire nation brand value of the UK, a marker of how quickly China is outpacing other countries.

Download a PDF of this report here:

Chinese companies make up 50 of the 500 most valuable brands globally, increasing from eight in 2008. Chinese brands lead in four sectors – banks (ICBC); spirits (Moutai); insurance (PingAn); and real estate (Dalian Wanda) – compared with none in 2008.

Enhanced image

“In a virtuous circle, Chinese brands and the transformed national image of China as an emerging global power are reinforcing each other and further add to the country’s attractiveness to investors and tourists,” says Brand Finance CEO David Haigh.

“In relative terms, China’s nation brand value grew 44% year on year, or at a pace 20 times faster than the US. However, at $10,200bn, China’s nation brand value is still only half that of the US's, and sustaining growth will be key to narrow the gap.”

To compile the rankings, the consultancy Brand Finance measured the strength and value of the nation brands of 100 leading countries using a method based on the royalty relief mechanism employed to value the world’s largest companies.

US stagnation

With a value of $21,100bn, the US remains the most valuable nation brand in the world but low growth of 2% year on year is putting its dominance at risk in the long run.

“The US’s nation brand value’s stagnation can be attributed to macroeconomic challenges, such as the declining participation rate caused by the mass retirement of baby boomers, ultimately contributing to a slow pace of GDP growth compared with previous expansions,” says Mr Haigh.

“However, perceptions of Donald Trump’s presidency are not exactly helping Brand America. Mr Trump’s administration is seen as increasingly unpredictable and although tax relief promises can boost FDI in the short run, a failure to fulfil them, considering that many propositions of new legislation fell through in Congress, will make investors’ confidence disappear,” he adds.

The dynamic between American and Chinese nation brands is mirrored by the broader trends of Western stagnation and Asian advance. Established European nation brands, such as Germany, the Netherlands, Belgium, Switzerland, Sweden and Austria, recorded either a decline or a negligible growth of value in this year’s league tables, while Asian nation brands are rising up the ranks rapidly. Vietnam, the Philippines, Thailand and South Korea have all added 37% to 43% to their nation brand value in the past year.

Southern European countries can also boast record nation brand value growth year on year as they regain confidence following their recovery from crisis, and pursue reforms. Portugal is up 22%, Italy 34%, Greece 41%, Spain 46% and Cyprus 57%.

The fastest growing nation brand of 2017, however, is Iceland, up 83% from last year in value, on the back of a tourism boom. The most reliable performer is Singapore. It not only maintained its position as the strongest nation brand this year, but with a Brand Strength Index BSI of 92.9, it is also the only country to score more than 90.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.