Fintech Locations of the Future 2019/20: London tops first ranking

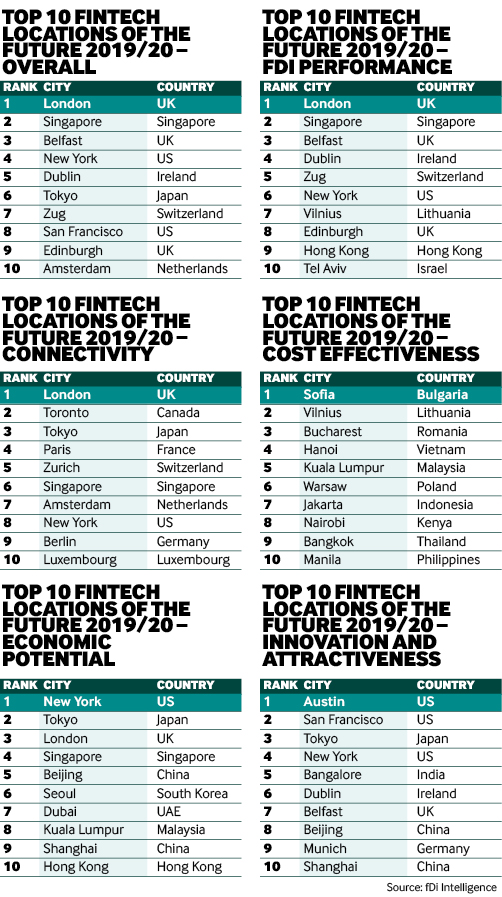

London has been named fDi’s inaugural Fintech Location of the Future for 2019/20, followed by Singapore and Belfast.

Despite Brexit uncertainty, London ranks first in fDi’s inaugural study of financial technology (fintech) locations. According to greenfield investment monitor fDi Markets, the UK capital attracted 156 inward fintech investment projects between 2014 and 2018, the highest of all cities included in the analysis. It also tops the FDI Performance category. London attracted almost 50% more fintech projects than its closest competitor, Singapore, and brought in the highest number of fintech co-location and expansion projects (25).

Download a PDF of these rankings here:

London triumphs in the Connectivity category due to its IT and transport infrastructure. The city boasts six airports located within 80 kilometres, serving more than 320 international locations. It also performs well in the Environmental Performance and Network Readiness indices. Improving digital connectivity is a top priority for the local government, as shown by mayor Sadiq Khan’s Connected London programme, which seeks to coordinate connectivity and 5G projects to drive the next wave of innovation in the city.

Singapore's surge

City-state Singapore is in second position overall. It attracted $1.74bn in fintech capital investment between 2014 and 2018, the largest amount of all the locations analysed. Data from fDi Markets shows that 2018 was a bumper year for Singapore’s fintech FDI, welcoming its largest number of fintech projects (28), investment ($533.6m) and jobs (1011) since records began in 2003.

In January 2018, New Zealand-based Youtap, a mobile financial services company, relocated its corporate headquarters to Singapore in recognition of the country’s growing influence in the global fintech sector, noting: “Singapore has established an enviable position as a leading Asian financial technology centre with an exciting innovation ecosystem, a great talent pool and fantastic infrastructure.”

Northern Ireland capital Belfast, which ranks third overall, fares particularly well in the FDI Performance category. According to fDi Markets data, jobs in the fintech sector made up more than one-fifth of all FDI jobs created in the city between 2014 and 2018.

Global corporations such as Citi, Allstate and Liberty Mutual have established and expanded their operations in Belfast. Economic development agency InvestNI says investors benefit from the strength of technology and innovative talent in the city as well as tailored government support packages combining practical advice and financial assistance.

FDI Strategy Spotlight

Porto, Portugal

InvestPorto operates as a one-stop shop for fintech investors, organising international missions, events and networking initiatives, and partnering with fintech-related businesses and clusters such as Porto Tech Hub. The organisation offers dedicated incentives for investors in the technology sector and its ScaleUp Porto scheme promotes a sustainable entrepreneurial ecosystem by providing knowledge, access to talent and customers and funding to high-growth companies.

Halifax, Canada

Nova Scotia Business Inc (NSBI) boasts a team of seven people dedicated to attracting investors in fintech in the Canadian city. NSBI’s attraction and retention strategy centres on four initiatives: leveraging proprietary intelligence, supporting the site-selection process, presenting complementary business opportunities and providing comprehensive site visits. Incubators such as Volta Labs, Innovacorp and the IdeaHub also help start-ups grow by offering mentoring and resources.

Leeds, UK

Leeds City Region Enterprise Partnership offers a bespoke service for fintech businesses looking beyond London to expand their UK presence. Companies can access the expertise of the Leeds Institute for Data Analytics, the Cybercrime and Security Innovation Centre and the Quantum Communications hub. The #Welcome Digital Inward Investment Fund also offers between £10,000 and £50,000 ($12,150 and $60,750) of grant funding for eligible digital and technology businesses.

Cape Town, South Africa

Wesgro, the official investment promotion agency for Cape Town and the Western Cape, formulates, executes and manages public policy to attract increased levels of technology investment into South Africa. The agency holds inward and outward roundtable delegation missions with executives, creates digital social media campaigns and facilitates access to private and public funding.

Munich, Germany

Munich’s Department of Labour and Economic Development assists domestic and international companies with relocation issues and coordinates incentive programmes on their behalf. The city hosts fintech events such as Digital Insurance Agenda, which aims to accelerate innovation by connecting insurance executives with insurtech leaders, and is home to fintech incubators Finconomy and the InsurTech Hub.

Frankfurt, Germany

The Frankfurt Economic Development Agency helps develop the city’s fintech ecosystem by facilitating communication between investors, the public sector and financial institutions and by organising events. The unit encourages innovation in the sector by focusing support on accelerator and incubator TechQuartier, which develops programmes and events by matching corporates and venture capital firms with start-ups, as well as co-planning exclusive events and roadshows.

Toronto, Canada

Toronto Finance International (TFI) works with stakeholders across Toronto to attract and retain investors in the fintech sector. As the head of Toronto’s financial services cluster group, TFI brings together government representatives at federal, provincial and city level and government agency Toronto Global. Its extensive investment promotion strategy includes international promotion at key events, influencing policy and regulatory issues, talent initiatives and partnerships with similar entities in key global financial centres.

Vilnius, Lithuania

Go Vilnius helps strengthen growth in the Lithuanian capital's fintech sector by regularly contacting businesses for feedback on potential areas for improvement, offering direct support and co-operating with educational institutions to ensure a sufficient supply of labour for the industry in the future. In 2019, the government revised its 2017 fintech action plan, adding measures to improve the legal environment, the management of related risks and increase demand for fintech products and services.

Methodology

To create a shortlist for fDi’s Fintech Locations of the Future 2019/20, the fDi Intelligence division of the Financial Times collected data using the specialist online FDI tools – fDi Benchmark and fDi Markets as well as other sources. Data was collected for 52 locations, under five categories: Economic Potential, FDI Performance, Innovation & Attractiveness, Connectivity and Cost Effectiveness. Locations scored up to a maximum of 10 points for each data point, which were weighted by importance to the FDI decision making process in order to compile the subcategory rankings.

List of data points:

Economic Potential

- Population

- GDP (PPP)

- GDP (PPP) per capita

- Unemployment rate

- Labour force

- Laws relating to ICTs

- Index of Economic Freedom

- Days taken to start a business

- Top 1000 World Banks 2018

FDI Performance

- Inward FDI (2014-2018)

- Outward FDI (2014-2018)

- Number of inward FDI projects as a % of country FDI (2014-2018)

- Number of fintech projects (2014-2018)

- Number of fintech projects per 100,000 (2014-2018)

- Capex for fintech projects (2014-2018) ($m)

- FDI fintech jobs (2014-2018)

- Fintech FDI as a % of all FDI (2014-2018)

- Fintech capex as a % of all capex (2014-2018)

- Fintech jobs as a % of all jobs (2014-2018)

- Fintech Co-location and expansion FDI (2014-2018)

Innovation & Attractiveness

- Number of companies in financial services

- Number of companies in software & IT services

- Number of companies in financial services as a % of all city's companies

- Number of companies in software & IT services as a % of all city's companies

- Startup USA Global Startup Cities Report - Established Global Startup Hubs ranking

- Savills Tech City Index

- ICT service exports (% of service exports, BoP)

- International trade in ICT services, value, shares and growth, annual

- Innovation Cities Index 2018

- Number of fintech patents 2003-2018

- Number of fintech patents 2003-2018, per 100,000

Connectivity

- Number of airports - within 50 miles (80 km) of the city

- Distance to nearest international airport (km)

- Number of international destinations served from airports (across borders, without a custom check requirement)

- Internet upload speed (Mb/s)

- Internet download speed (Mb/s)

- Networked Readiness Index 2016

- Environmental Performance Index 2018

- Quality of overall infrastructure

Cost Effectiveness

- Annual rent for prime Grade A office space ($ per sq m)

- Annual rent for prime Grade A industrial space ($ per sq m)

- Average salary ($) for skilled worker

- 4*/5* hotel in city centre ($ per night)

- Total tax and contribution rate (% of profit)

- Corporation tax rate (%)

- Cost of establishing a business (absolute value using GNI)

- Cost of registering a property (% of property value)

- Common indirect tax/VAT

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.