fDi’s Top Tiger Cub Cities 2018: Ho Chi Minh shows its claws

The ‘tiger cub’ economies of south-east Asia include some of the world’s fastest growing countries. Cathy Mullan looks at which cities are doing the best job of enticing investment in the region.

Asia’s tiger economies – Hong Kong, Taiwan, Singapore and South Korea – were denoted as such in the 1960s, at the confluence of major technological advances and a more stable world order. These countries invested in their infrastructure and youthful workforce, and created tax incentives for foreign investors.

The tigers’ move from an industrialised economy to a more services-based export economy is now being emulated by the five ‘tiger cub’ economies of Vietnam, Thailand, Malaysia, Indonesia and the Philippines. In 2013, for example, more than 38% of the combined national GDP was derived from the services sector, a figure that rose to more than 41% in 2017.

Ho Chi Minh roars ahead

Ho Chi Minh City in southern Vietnam tops the ranking of tiger cub economies. According to data from greenfield investment monitor fDi Markets, Vietnam’s most populous city attracted 288 investments from foreign companies between 2013 and 2017. It boasts an active services-based investment platform, attracting 39 business services, 34 financial services and 25 software and IT projects during this time.

Sales and marketing and business services operations together made up almost 60% of all projects in Ho Chi Minh City in this time. US-based multi-channel network Thoughtful Media established an office in the city in March 2016, to take advantage of the rapidly growing Vietnamese economy, while South Korea-based electronics giant Samsung opened a new exhibition centre in Saigon Hi-tech Park in November 2017.

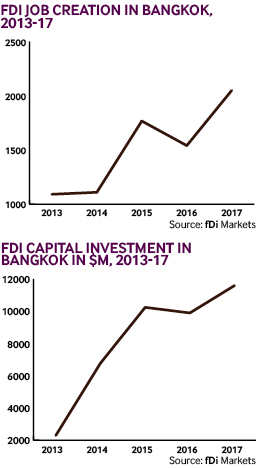

Thai capital Bangkok ranks second. In the five years to December 2017, 279 investors made a home in the city. According to fDi Markets, inbound capital investment and job creation peaked in the city in 2017.

Bangkok has enjoyed significant investment across a range of sectors. Danish jewellery company Pandora created 5000 jobs with the establishment of a crafting facility in the city’s Gemopolis Industrial Estate. UK-based conglomerate Unilever established its Thailand headquarters in the city, opening an 18,000-square-metre office facility at a cost of just over $80m.

Kuala Lumpur ranks in third position in this study, welcoming 267 projects between 2013 and 2017. The highest number of investments (59) came in the software and IT sector.

The Malaysian government offers a series of incentives to digital companies under its MSC Malaysia status programme. The Malaysia Digital Economy Corporation awards the status to ICT and ICT-facilitated businesses, ensuring tax breaks and eligibility for R&D grants. Netherlands-based online coupon and deals platform Saleduck credited its March 2016 investment decision to the MSC Malaysia status programme.

Methodology

To compile the list of locations for this study, fDi Intelligence, a data division of the Financial Times, looked at the FDI data between January 2013 and December 2017 on fDi Markets. Top cities in the tiger cub economies (namely, Indonesia, Malaysia, Philippines, Thailand and Vietnam) were ranked based on their record of attracting FDI. Project numbers, capital investment and job creation were considered.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.