Brexit gifts Europe $1.6bn FDI boost

Investors announced as many as 65 relocations from the UK into the EU in the wake of the June 2016 referendum.

Brexit has won EU countries a $1.6bn boost in FDI as companies from all over the globe relocated operations from the UK to adjust the matrix of their European interests according to the results of the June 2016 referendum.

As many as 59 companies announced 65 relocation projects from the UK into the EU between July 2016 and December 2019, when the landslide win of the Conservative party at the December 12 elections put an end to months of uncertainty and paved the way for Brexit to finally happen on January 31, figures from foreign investment monitor fDi Markets show. The total amount of FDI unlocked by these relocation projects stands at $1.65bn, fDi Markets estimates.

UK companies led the way with 23 announced relocations, followed by US companies (16) and Japanese ones (nine), fDi Markets figures show.

Sector-wise, financial institutions stood out as it soon became clear that they would lose the right to sell financial services and products to clients in the EU from the UK – the so-called passporting rights. The likes of HSBC, JPMorgan, Barclays, Goldman Sachs and Morgan Stanley all announced relocations from London to the EU to hedge Brexit-related risks. Financial services accounted for 33 of the 65 announced relocations, fDi Markets figures show.

Companies relocating operations from the UK picked different EU cities for different reasons. Foreign investors picked Paris and Frankfurt to relocate their corporate and investment banking operations; asset managers favoured Dublin as their post-Brexit EU base, whereas non-financial investors chose Amsterdam: the Dutch capital attracted the European Medicines Agency previously based in London, as well as the headquarters of major tech companies like Japanese Sony and Panasonic.

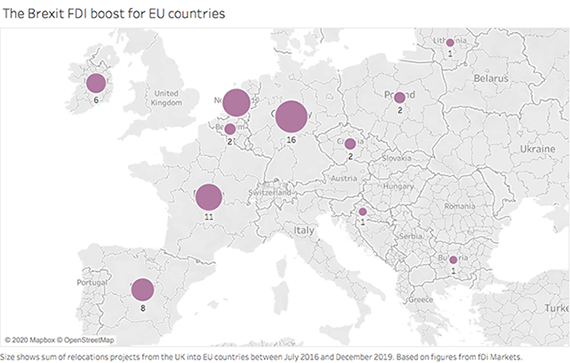

Overall, Paris with 10 and Frankfurt with nine attracted the highest number of relocation projects in the whole of the EU, followed by Amsterdam (8) and Dublin (6) and Madrid (5), fDi Markets figures show. At a country level, Germany attracted the highest number of relocations (16), followed by the Netherlands (12), France (11), Spain (8) and Ireland (6).

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.