Where do German companies invest?

fDi Intelligence has examined Germany’s outward investment history and found China is still the leading FDI destination, thanks in large part to Shanghai’s industrial and chemicals industry. Vicky Napier looks at the results.

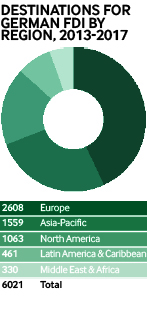

Between 2013 and 2017, fDi Intelligence recorded a total of 6073 projects outbound from Germany, representing $243.64bn in outward investment and more than 815,000 new jobs. The following study identifies the prevailing destinations for German investment during this period, with a particular focus on leading destination countries and destination cities, both globally and regionally.

At a destination city level, Shanghai comes top across the board. The Chinese financial hub claimed 141 projects, welcoming $4.95bn in capital expenditure (capex) from Germany as well as the creation of more than 18,400 jobs. The top sector attracting investment from German companies was industrial machinery, equipment and tools, followed by chemicals and automotive components, all ranking in the top five across projects, capex and jobs creation. Despite ranking second with 25 projects, Shanghai’s chemicals sector dominated in capex at $1.29bn. Germany’s leading chemicals company BASF claimed eight out of 11 chemicals projects into Shanghai, with its operations largely focused on chemical production serving the Chinese automotive industry.

Of the projects that cited motives for FDI, 60% attributed their investment to domestic market growth potential. In 2016, 48.6 million light vehicle units were produced in the Asia-Pacific region, accounting for 52% of global production. BASF predicts that 60% of global chemical production will take place in Asia by 2020, with more than half of that in China.

China motors on

At a country level, China has maintained its grip as a leading destination market for German investment. Despite ranking second for investment projects, China came out on top for both capex and jobs creation, with $36.2bn and more than 120,000 jobs, respectively. Mirroring German FDI into Shanghai, the automotive and chemical sectors dominated nationwide for project numbers. Again, China’s growing automotive industry attracted the majority of investment into the country. In total, almost $19bn was invested and more than 58,000 jobs were created in the automotive components and automotive OEM sectors. In addition, the chemicals sector maintained its leading position at national level, ranking in the top five across the board.

With an already successful automotive industry, Germany appears to be harnessing the recent automotive growth in China. In 2017 Chinese premier Li Keqiang and German chancellor Angela Merkel signed a series of deals and co-operation agreements with a focus on areas such as automatic driving and aviation. Included was a memorandum of understanding between Beijing Automotive Group and Daimler on increasing investment and strengthening strategic co-operation in new energy vehicles, as well as an agreement between Baidu and Bosch on autonomous driving technology. In addition, the respective parties agreed to accelerate the signing of an investment treaty to assist with discussions on a free-trade agreement.

When looking at destination cities on a regional level, Dubai tops all three tables for projects, jobs and capex into Middle East and Africa, securing more than one-fifth of projects into the region. In total, Dubai welcomed $1.61bn capex and more than 4000 jobs from German companies. Transportation was the leading sector, winning 15 investments, with Deutsche Post as the largest investor. The company predicted strong growth in the Middle East in 2018, driven by an expanding e-commerce sector and an upswing in global business sentiment.

Methodology

To compile the list of locations for this study, fDi Intelligence, a data division of the Financial Times, looked at the FDI data between January 2013 and December 2017 for cities receiving investment from German locations. Locations were ranked on their record of investment, taking into account project numbers, capital expenditure and job creation. Retail was excluded in this study.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.