Super 60 secondary cities: closing the gap?

International investors and politicians stand accused of overlooking the depth of talent, productivity and opportunity outside of Europe’s capitals to their detriment. Sebastian Shehadi reports on the secondary cities that should be on their radars.

As global competition and connectivity grows, the battle for foreign investment is increasingly between cities, rather than countries, and capital cities' economies of scale and high profiles have traditionally made them attractive and familiar destinations for foreign investment.

But astute investors are beginning to look beyond the obvious to the huge potential of secondary cities. The Tier 2 (T2) locations that are tending to succeed have visionary local and national leadership, unique branding and a global mindset. Since there is no agreed definition, our EU-focused report defines secondary cities as non-capital cities that have a population exceeding 200,000, such as Sheffield in the UK or Bilbao in Spain.

Generating GDP

Among the EU’s capital cities are a number of FDI hubs. Of the several thousand cities across the EU, the region's 28 capitals – plus the 'economic capitals' of Frankfurt, Barcelona and Milan – attracted 40% of all foreign investment projects into the bloc in 2018, according to greenfield investment monitor fDi Markets.

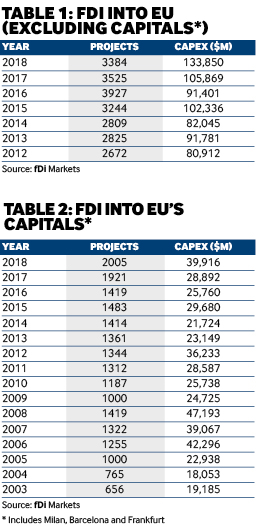

However, this also means the majority of foreign investment – 60% – went to secondary cities and beyond, and these EU destinations (as a group) have had strong growth in FDI project numbers since 2012 (see table 1) according to fDi Markets. In 2018 they experienced the largest level of inbound FDI since 2012, at $133.85bn (or 71% of the EU total), while the EU’s capitals received the remaining 29%, or $39.9bn.

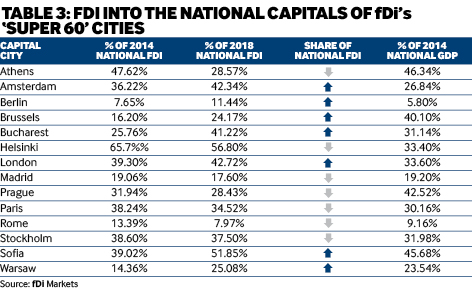

And while EU capital cities as a group have seen a rise in FDI projects since 2010 (see table 2), their expansion has been uneven, with many suffering a decline in their share of national FDI between 2014 and 2018 (see table 3), according to fDi Markets.

A report from business consultancy McKinsey has found T2 cities are driving global growth by generating roughly 50% of global GDP. Although its definition of secondary cities differs from that of fDi – as it adapts for a global context – McKinsey reports that T2 cities are poised to outperform most leading cities, such as New York, London and Paris, in their absolute level of growth, based on demographics, households and incomes.

A fair share?

EU capitals tend to attract more of their respective country's FDI than the amount they contribute to its GDP (see table 4), according to investment analyst fDi Benchmark. For example, Helsinki garnered 65% of Finland’s FDI intake in 2014, but contributed 33.4% to the country’s GDP that year. London attracted 39% of the UK’s FDI, versus a 30% GDP contribution, in 2014, while Paris saw 38% versus 30%, respectively, and Amsterdam 36% versus 26%.

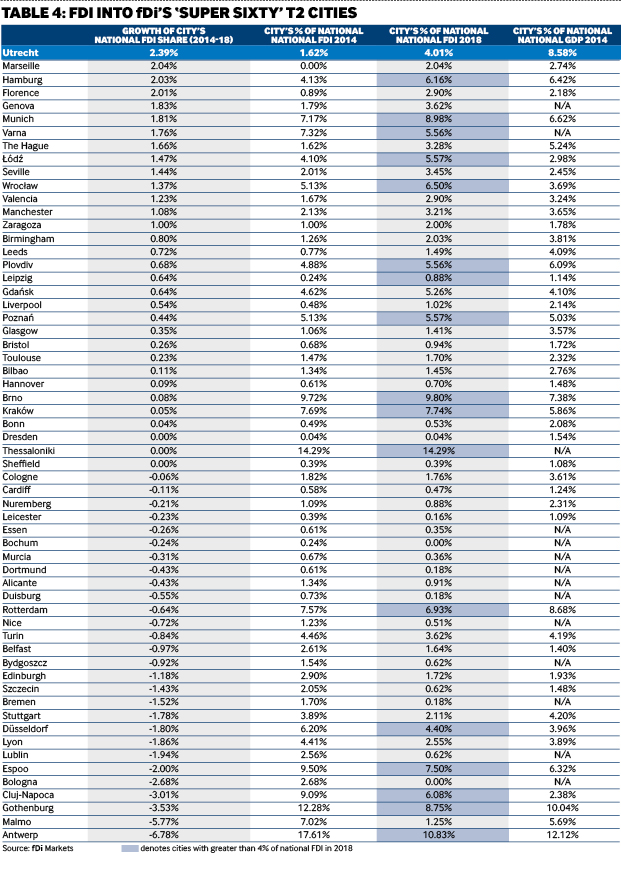

However, the opposite is true for most of the 60 secondary cities studied in this report, according to fDi Benchmark (see table 4), suggesting that T2 cities are not receiving the foreign attention they deserve. For example, Utrecht accounted for 8.58% of the Netherlands' GDP in 2014, but attracted only 1.62% of the country’s FDI; Leeds contributed 4.1% to the UK’s GDP in 2014, but received only 0.77% of its FDI; Valencia contributed 3.24% of Spain’s GDP versus 1.67% in FDI intake.

Sweden’s Gothenburg and Malmo also performed well in 2014, as did many German secondary cities. Polish cities were a notable exception, however, with Łódź, Wrocław, Gdańsk, Poznań and Kraków receiving higher shares of Poland’s FDI than they contributed to GDP in the same period.

Conversely, most secondary cities in France, Spain, Holland and the UK experienced a disparity between FDI received and GDP generated in 2014. Although GDP is not an exact marker of a city’s FDI potential, the above disconnect suggests many foreign investors may be overlooking the economic productivity and opportunity of certain T2 cities.

The Super 60

The ‘Super 60’ secondary cities in this report (see table 4) were selected based on population size, business activity and FDI climate. Each city’s share of national FDI, in terms of inbound project numbers, has been ranked by its growth between 2014 and 2018.

In this regard, the ranking finds that exactly half of the 60 cities witnessed positive growth in this period. Utrecht is the fastest growing, followed by Marseille and Hamburg. Secondary cities from Germany, Italy and Holland dominate the top 10.

Utrecht has received an ever-growing number of FDI projects since 2012, with a 15-year record high in 2018 thanks to 11 projects valued at $430m, according to fDi Markets. The most significant investment in the city in 2018 was VodafoneZiggo’s announcement that it would start rolling out its new fixed gigabit network there.

Among the ranking’s 30 ‘positive growth cities’, the UK and Spain are notable as most of their entries have gained ground. Madrid’s share of Spanish FDI decreased between 2014 and 2018, but 2018 saw big gains for other Spanish cities. For example, Bilbao had its highest ever number of FDI projects in 2018, with major investments from Ireland's Accenture, Israel’s Leonardo Hotels and France’s Seur.

Notably, 18 cities among the ‘Super 60’ accounted for more than 4% of their respective country's inbound FDI in 2018, with Thessaloniki in Greece boasting the most, at 14.29%.

Six of these cities are Polish, a country that can claim to have the most balanced spread of greenfield FDI across its capital and secondary cities. The same is true to a lesser extent for Germany. Reflecting this, Berlin and Warsaw represent relatively low shares of their country's FDI, compared with other EU capitals.

Getting noticed

Being lower profile tends to mean that secondary cities must work harder than capitals to gain international attention and investment, and an important facet to their success is branding.

“The most important thing for T2 cities is to identify their unique story and unique value add. Too many places are trying to be something they’re not, trying to copy models that made London successful, for example. Consequently, they don't focus on themselves,” says Peter Griffiths, city strategist at ING Media, an international PR and communications agency for the built environment. In other words, what is a city’s story? What can people experience in that city alone, in terms of culture, nature, business, talent, etc? Why have thousands of people chosen to live there?

Mr Griffiths recently oversaw ING’s report, 'Europe’s most talked about cities', which ranks locations by their online visibility versus their ranking in 24 global surveys, such as the Economists' Livability Index. Secondary cities performed well in the report, France's Lyon being particularly impressing through its digital presence.

“Lyon’s online conversations are around tech – the city is positioning itself in that new space, and that's becoming a brand that did not exist five years ago. Tech is a strategic sector to develop, but it’s not a golden ticket for T2 cities; you need the right infrastructure, connectivity and talent, and more importantly, to start mobilising your unique skills and story,” says Mr Griffiths.

Liverpool's Euro success

Successful secondary cities also tend to have strong local leadership and Liverpool’s economic transformation since the 1980s is a good example of this.

“It takes 35 years to be an overnight success, a long time to change a place’s psychology, infrastructure, etc. The role of the public sector – EU and national – was tremendously important for Liverpool at key moments,” says professor Michael Parkinson, associate pro vice-chancellor for civic engagement at the University of Liverpool.

For example, public sector initiatives and several billion pounds drove the regeneration of central Liverpool to the extent that it was named European Capital of Culture for 2008. This lifted the city’s self confidence and international image, catalysing both domestic and foreign investment, according to Mr Parkinson.

However, the UK government’s policy towards its secondary cities stands accused of being inconsistent over the decades, especially since the 2008 financial crisis, a trend seen elsewhere in Europe. Excessive investment in capital cities and under-investment in T2 cities has been the prevalent strategy in too many EU countries, according to a report overseen by the European Institute for Urban Affairs at Liverpool John Moores University. It found that national governments need to strategically invest in T2 cities, rather than concentrate all their resources on the capital.

As an example, about 55% of digital jobs in the UK are in the south-east region, around London, while just 12% are in the country’s north, according to the UK-based Centre for Towns organisation. Citing its report, UK politician Jo Platt recently asked outgoing UK prime minister Theresa May: “Are you going to do anything to help renew our post-industrial northern towns with the emerging digital and cyber sectors? Or has [Brexit] killed off any attempt to bring together the north and the south?”

Mr Parkinson, who is also a board member of the UK government’s Regeneration Investment Organisation, says the UK government currently has no vision for T2 cities. “The current administration is much less interested in the devolution agenda, and much more wedded to London, devoting all its energy to Brexit. Plus, with austerity, there's no money for devolution,” he adds.

UK-Canada match-up

Mr Parkinson says that equally as important as national policy is local leadership, which has the ability to work with private businesses and internationally. Two examples are Canada’s Edmonton and the UK’s Sheffield, and the cities’ public and private leaders joined forces a few years ago to create the first international T2 City Network.

“By identifying cities, connecting people and exploring mutual opportunities and challenges, [the T2 City Network helps us] build trade partnerships, identify investment opportunities [and raise our international profile],” says Faaiza Ramji, the principal at Edmonton-based business marketing firm OnPurpose.

The network, which is still informal and taking shape, is organising a T2 City Summit in Sheffield in 2020. It hopes to move participants beyond knowledge-sharing towards collaborating on joint programmes and, in time, foreign investment, according to Edward Highfield, director of city growth at Sheffield City Council.

“Sheffield has become a successful T2 city because its political and business leaders have identified the city’s role in the global economy, especially in R&D. We’ve attracted investment through the right infrastructure while offering a world-class quality of life. Younger generations increasingly seek out experiences rather than assets”, adds Mr Highfield.

Both cities have identified their sectoral strengths. Edmonton is a global leader in artificial intelligence, machine learning and aerospace, while Sheffield is internationally recognised for its creative media, advanced manufacturing and health and wellbeing sectors.

As well as boasting world-class universities, both cities also understand the importance of promotion. Sheffield’s recently formed Brand Partnership – a joint effort between local government, businesses and universities – is central to that effort.

“In Edmonton, we’ve taken the time to understand what makes this place unique and why people choose to stay here. The advantage that T2 cities have is that we’re not stuck with a reputation yet – we still have a chance to build one. So we need to be intentional about what we want it to be, and who we want to attract,” says Ms Ramji.

One of Edmonton's slogans sums it up: ‘Some cities are finished; others you can change.’ This is an opportunity T2 cities should seize.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.