Ten emerging post-Brexit trade prospects for the UK

Insurance company Beazley has identified the most promising emerging markets that UK exporters should target following the country's vote to leave the EU, as Neil Beattie and Emma Whiteacre report.

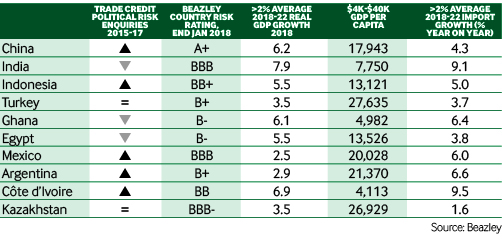

For British exporters feeling gloomy about the implications of Brexit, opportunities further afield may help them feel more optimistic. Political risk and trade credit insurer Beazley has taken a look at 10 countries where rising levels of economic growth are attracting UK exporters and driving demand for insurance cover, which in many cases is essential for investment to take place.

Beazley’s assessment of potential trade opportunities was based on four criteria:

- Economies that are projected to grow by an average of 2% or more over the next five years, with import growth also above 2%;

- Current average income levels of between $4000 and $40,000 (on a purchasing power parity basis) as these are evidence of disposable income among emerging markets. The threshold allows us to focus on emerging markets rather than developed ones;

- Existing business flows as evidenced by political risk and trade credit enquiries;

- Analysis of existing trade relationships with the UK in terms of goods and services.

As a result, Beazley has identified the following 10 countries as among the most dynamic emerging markets that UK exporters should be exploring.

China and India lead the way

China’s ongoing shift from export- to consumption-led growth, and from manufacturing to services, makes it a target market for the UK’s world-leading industries. A newly announced $1bn fund led by former UK prime minister David Cameron will support bilateral trade and investment, in particular promoting the development of infrastructure linkages as part of China’s One Belt One Road initiative.

Opportunities abound in both the sovereign and private sectors, but exporters still need to be cautious in the coal-related and the so-called ‘teapot’ (that is smaller, privately owned) refineries sectors, and in the vast state-owned entity sector. While the latter’s creditworthiness is showing signs of improvement as a result of lower leverage, special effort should be made to understand corporate structures and the true level of state involvement.

The UK and India enjoy established business and cultural relationships, which UK exporters should be capitalising on. Growing demand for instruments, machinery and transportation provides synergies with the UK’s more technical specialisms. Add in the gradual liberalisation of India’s FDI regime across many economic sectors, and the future looks promising for UK exporters.

However, businesses still need to be cautious regarding credit and political risks in the private sector, and the steel sector in particular, following some high-profile insolvencies in India in 2017. Nonetheless, the country's economic expansion and growing maturity mean that capacity is available where exporters can demonstrate sufficient due diligence and good track record.

Rising Indonesia and Turkey

As one of the fastest growing economies in the world, Indonesia is forecast to accelerate to 5.3% growth in 2018. And, under modernising president Joko Widodo, the country is increasingly being recognised as an attractive investment destination. Bilateral relations with the UK are solid, and trade and diplomatic linkages are rapidly increasing. Economic co-operation between the two countries, for example in the fields of research and innovation, and educational ties, are expected to increase. Growing demand is being seen in the mining and oil and gas sectors in particular.

Exporters should nonetheless be aware of the low-level risk of terrorism and social instability in Indonesia, and, more significantly of corruption, which remains pervasive across the state and in public-private transactions.

Turkey’s relationships with the West may be strained by political differences of opinion regarding Syria and other countries within the Middle East and north Africa region, but the country’s economic development cannot be ignored. Ongoing industrialisation and robust consumer demand, coupled with the benefits of market liberalisation measures in recent years, are providing an improving environment for FDI inflows into this strategically important and dynamic economy, which is projected to grow by an average of 3.5% over the next five years. This is reflected in sustained levels of interest in traditional political risk cover for infrastructure projects, with location and sector remaining key considerations.

African opportunities

In West Africa, the two fast-growing economies of Ghana and Côte d’Ivoire are putting the challenges of the recent past behind them, with projected average annual growth rates of 5.9% and 7.1%, respectively. In Ghana, which is recovering from a fiscal crisis and power shortages, demand is growing for credit and political risk cover across all industries, especially at Ministry of Finance level, which Beazley sees as a safer bet than the sub-sovereign level.

Likewise in Côte d’Ivoire – which is also on a more stable footing seven years on from deadly post-election clashes – demand for political risk and credit insurance is picking up. However, there have been some recent payment delays experienced in the oil and gas sector so some caution is required.

In north Africa, Egypt is already the destination for $1.2bn-worth of UK goods a year, led by foodstuffs and iron and steel, with foreign-made products very much in demand. The country is an increasingly attractive investment destination as the flotation of the currency, market liberalisation and government-led infrastructure development are beginning to transform the economy. Foreign investments that are fundamental to the wellbeing of the economy – notably oil and gas, consumer goods and infrastructure projects – are the most likely to secure essential political risk and trade credit insurance because of their strategic importance.

Strong appetite in Latam

Meanwhile, in Latin America, Beazley has a strong appetite to cover trade and investment flows into Mexico and Argentina, where real GDP growth of about 2.5% and 3%, respectively, is anticipated between 2018 and 2022, alongside import growth in excess of 6% in both markets.

Mexico has built up a good track record in recent years and that can be expected to continue, notwithstanding the upcoming elections in July. Since the renegotiation of the North American Free Trade Agreement and US president Donald Trump’s proposed construction of a border wall, Mexico is likely to diversify the sources of its imports away from its northern neighbour. In particular there are opportunities with the well-performing sub-sovereign sector and for businesses selling machinery, vehicles and vehicle parts, and pharmaceuticals.

In Argentina, the economic shift currently under way, led by market-friendly president Mauricio Macri, is proving painful to the electorate and is burning through Mr Macri’s limited political capital, so caution is also warranted. But Argentina remains a significant importer ($856bn in 2016), especially for transportation goods, pharmaceuticals and electronics, so British companies’ efforts to capture a larger share stand to be successful. Increasing appetite on the part of insurers and investors is keeping a lid on political risk premium rates, and preventing them from rising commensurate with our perceptions of the level of country risk.

Kazakhstan’s diversification drive

While the forecast for import growth for Kazakhstan falls just below Beazley’s 2% threshold, we felt it warranted inclusion because of the opportunities that exist. The government is focusing on economic diversification, has overhauled investment legislation to attract greater FDI participation in the local economy and joined the World Trade Organization in 2015.

As a result, Beazley sees attractive trade and investment opportunities in renewables, financial services, agriculture and technology. With its vast natural resources, Kazakhstan has been a good source of business to the political risk market for some time, largely on the sub-sovereign side. Highly rated entities with producing assets coupled with a continued need for further investment should see this continue.

Neil Beattie is a political risk and trade credit underwriter and Emma Whiteacre is a country analyst at Beazley, a UK-based insurer.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.