How to identify target sectors for inward investment

A new methodology for identifying key target sectors for inward investment has been created using the principals of revealed comparative advantage. Glenn Barklie reports.

fDi Intelligence and Wavteq have published research on a new methodology into how economic development organisations (EDOs) and investment promotion agencies (IPAs) can develop a sector strategy to attract inward investment.

What is 'revealed comparative advantage'?

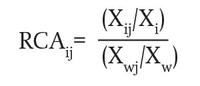

Revealed comparative advantage (RCA) is an important tool for policymakers to understand a location’s relative strengths and weaknesses. The theory of revealed comparative advantage is more generally applied to export data and is denoted by the formula:

Where Xij is the value of country i’s exports of product j; Xi is the country’s total exports; Xwj is the value of world exports of product j; and Xw is world total exports.

A value of greater than one implies that the country has an RCA in the product. If the value is less than one, the country is said to have a revealed comparative disadvantage in the product.

In analysing 2016 Tunisian export data, it was discovered the country had an RCA in 235 of 1225 export subsectors compared with its regional market competitors in the EU and north Africa. Tunisia had a significant comparative advantage in (i) instrument panel clocks and clocks of a similar type for vehicles, aircraft, spacecraft or vessels; (ii) fluorides, fluorosilicates, fluoroaluminates and other complex fluorine salts; (iii) diphosphorus pentoxide phosphoric acid polyphosphoric acids; (iv) flax yarn; and (v) tracksuits, ski suits, swimwear and other garments.

How can RCA be applied to FDI data?

Although historically the limited availability of FDI data has hindered the application of RCA theory to FDI, the report argues the availability of new greenfield FDI datasets now makes the application possible. These datasets (unlike most trade datasets) can be disaggregated to the sub-national level – enabling inter-industry comparative advantage analysis for states, regions, counties and cities. These are often the geographic levels at which corporate location decisions are made, where industry clusters are formed, and they are the geographic levels compromising most of the world’s EDOs and IPAs.

The research uses project-level data from the fDi Markets database of greenfield FDI projects for the period 2005 to 2013. In total, fDi Markets tracked 144,864 greenfield FDI projects in this time with associated capital investment of an estimated $8290bn, creating an estimated 23.7 million direct new jobs.

Greenfield FDI data was collected upon three important metrics for EDOs and IPAs:

- Projects

- Job creation

- Capital investment

The theory of RCA was applied to develop a new RCA index to analyse the comparative advantage of locations for FDI.

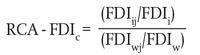

RCA for FDI (RCA-FDIc) – country level

Where FDIij is the volume of FDI into country i in sector j; FDIi is the total volume of FDI into country i; FDIwj is the volume of world FDI in sector j; and FDIw is the total volume of world FDI.

A score of more than one indicates that the country has an RCA in the sector for inward FDI. A score of less than one indicates that the country has a revealed comparative disadvantage in the sector for inward FDI.

The country level model can be easily adapted to a subnational level model. For example, to understand RCA:

RCA-FDIr = (FDIkj/FDIk)/(FDIij/FDIi)

Where FDIkj is the volume of FDI into region k in sector j; FDIk is the total volume of FDI in region k; FDIij is the volume of FDI into country i in sector j; and FDIi is the total volume of FDI into country i.

This model presumes that sub-national regions are primarily competing for FDI with other regions within their country. However, for sub-national regions that are competing against other regions internationally, the model can be easily adjusted. For example, the RCA-FDI of FDI going to Kuala Lumpur could be based on its market share of FDI going to Asean members rather than to Malaysia.

Application of the country model and results

The RCA-FDIc indexes were calculated for nine major economies (Canada, China, France, Germany, India, Russia, the UK, the US and the EU 28) using the greenfield FDI dataset. The RCA indexes were calculated for each of the three FDI indicators (FDI projects, jobs and capital investment) across 39 sectors from 2005 to 2013. In total, 72,688 inward FDI projects were recorded, accounting for more than half of all global FDI projects. FDI job creation in the nine economies was estimated at 10.8 million jobs (46% of world total) and capital investment was estimated at $3310bn (40% of world total).

To provide large enough sample sizes for time series analysis, the dataset was split into three three-year periods (2005 to 2007, 2008 to 2010, and 2011 to 2013). The RCA indexes were calculated in each period for the three indicators: number of FDI projects, jobs and capital investment.

The RCA calculations provide unique insight into which sectors each country has a revealed comparative advantage and how RCA is changing over time. Some of the key findings for a selection of countries are:

- Canada: RCA for FDI primarily in advanced manufacturing (FDI projects in engines and turbines, aerospace, pharmaceuticals), natural resources (capital investment in minerals and coal, oil and natural gas) and services sectors (job creation in software and IT, financial services and business services). The automotive OEM sector stands out as a sector where Canada has lost its RCA for FDI, with the RCA score declining in each period. An explanation for why Canada lost its RCA for automotive OEM could be the growing competition from Mexico and the high value of the Canadian dollar during this period, making Canada less cost competitive;

- China: RCA for FDI across most manufacturing sectors and in the real estate and hotels and tourism sectors. The only services sector where China has an RCA is for capital investment in financial services. This is likely due to the volume of capital investment needed to establish China-wide retail and commercial banking operations. Based on the job creation and capital investment indexes, the RCA analysis shows that China lost its RCA in the textiles sector. This suggests that China has become less competitive for the larger textiles projects, likely due to rapidly rising labour costs and the tight labour market in China with alternative locations, such as Vietnam, becoming more attractive for the larger projects;

- UK: RCA across all time periods and FDI indicators in four sectors: aerospace; alternative/renewable energy; software and IT; and retail. Across all FDI indicators, the UK also has an RCA in the most recent period in engines and turbines, while the UK has lost its RCA in space and defence. The RCA in engines and turbines is likely to be closely related to the growth in alternative/renewable energy (especially wind farms, which are the key source of demand for turbines in the UK) while the lost RCA in space and defence is likely due to stagnant UK defence expenditure for many years (the EU has also lost its RCA in space and defence). In the most recent period, the UK had its highest RCA score for capital investment in the real estate sector;

- US: RCA in every time period across all FDI indicators in eight sectors: automotive components; biotechnology; industrial machinery, equipment and tools; medical devices; pharmaceuticals; software and IT; space and defence; and wood products. In the most recent period, the US also has an RCA across all FDI indicators in the leisure and entertainment and textiles sectors. For capital investment, the US also has an RCA in alternative/renewable energy, semiconductors, and retail in every time period.

Implications

This new technical method specifically designed to identify target sectors for inward investment attraction combines the theory of RCA as applied to exports – one of the most important theories in international economics – with direct investment demand analysis to directly apply the principle of revealed comparative advantage to FDI.

Through the use of the RCA-FDI model, sectors in which the world’s largest economies have an RCA for inward FDI were identified.

This study presents the first theoretical model to apply the theory of RCA to FDI, providing a new analytical tool to understand the comparative advantage of countries, regions and cities for FDI. The report makes a major contribution to international economics theory and the study of regional economics by adapting the theory of RCA to FDI.

EDOs and IPAs can use the RCA-FDI model to identify in which sectors a country, region or city has a comparative advantage for FDI and how this is changing over time. This is a new tool policymakers can use to develop their economic development and FDI attraction strategies. As the datasets on greenfield FDI are updated monthly, the changing comparative advantage of locations can be tracked on a continuous basis.

Download the full report which includes the country model and a sub-regional model for free: https://www.wavteq.com/publications/

Glenn Barklie is head of benchmarking services at fDi Intelligence, a specialist division from the Financial Times, of which fDi Magazine is also a part.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.