Why Serbia is back in favour with investors

After a sharp drop in 2012, FDI into Serbia has flowed back, with improvements in employment and public debt accompanying a rise in GDP. This new stability has drawn investment from the EU, the US and China.

Serbia has witnessed almost non-stop FDI growth for seven years, bouncing back after inflows plummeted in 2012, according to World Bank data. The influx has been particularly strong since 2015, going from €2bn to €3.5m in 2018, or 6% of GDP to 8.2%, respectively, the National Bank of Serbia (NBS) reports.

Further reading

Similarly, greenfield foreign investment to Serbia has grown steadily since 2014, when inflows dropped, to hit unprecedented highs in 2018 following the arrival of 105 individual projects, according to greenfield investment monitor fDi Markets. The landlocked country of 7 million inhabitants, and a candidate for EU membership, was recently ranked the world’s number one recipient of greenfield foreign investment when taking into account GDP levels, according to a 2019 list from fDi Intelligence.

IMF programme

Serbia looked very different in 2013, however, and sluggish growth meant it required external help. A year later, the country successfully agreed a fiscal consolidation programme with the IMF, leading to a vastly improved situation today. Its unemployment rate dropped to 9.5% in 2019, from about 26% in 2013, while public debt dropped from about 77% to 51% in this time, according to the Serbian ministry of finance.

Meanwhile, the country's GDP has grown almost consistently since 2014, hitting a 10-year high in 2018, at 4.4%. Despite international uncertainties and economic slowdown in parts of the EU, Serbia achieved 4.2% growth for 2019 – among Europe’s fastest rates and one of the few countries in the world to beat its yearly estimate, says minister of finance Siniša Mali.

Exports have performed similarly well over the past four years, hitting $19bn in 2018, with cars and insulated wire the leading goods, according to online data provider Trading Economics. The NBS believes Serbian exports will continue to grow at about 10% in the coming years, and a spokesperson says: “Alongside fiscal consolidation and monetary policy easing, Serbia has implemented numerous structural reforms, especially with regards to labour market flexibility, financial sector reforms and non-performing loan reduction, taxation policy, ease of obtaining construction permits, etc.”

Thanks to the recent reforms, Serbia has never had a more stimulating environment for investment, according to Marko Čadež, president of the Chamber of Commerce and Industry of Serbia. The country has a credit rating of BB+ with a 'positive' outlook, according to Standard & Poor’s, and it has shown impressive improvement in the World Bank’s Doing Business Index, rising from 93rd out 190 countries in 2013 to 44th in 2019.

Serbia has also made significant investments in new transport, energy and telecommunications infrastructure, with another $14bn being allocated for this over the next five years, adds Mr Čadež.

Renewed interest

With economic revival and reforms under way, foreign investors are stepping up their interest in Serbia. Increased foreign investment is expected for 2019, jumping to €3.8bn from €3.5bn the year before, according to the NBS. The majority of this, about 70%, still comes from EU countries, especially Germany, Italy, the Netherlands and Austria, who have invested heavily in Serbian manufacturing, especially automotive components.

American FDI is another prominent player, while Chinese investment has grown significantly in recent years, representing 20% of Serbia’s total FDI capital inflows in 2018, a record high, according to the NBS.

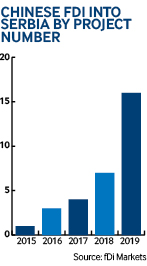

Since 2015, greenfield FDI from China to Serbia has grown exponentially, and hit unprecedented levels in 2019 with 16 projects valued at $625m, according to fDi Markets. “[China has] effectively made Serbia the hub of its Belt and Road Initiative in central and eastern Europe,” says Tena Prelec, research fellow at the University of Oxford’s department of politics and international relations.

The country received the highest amount of Chinese foreign investment out of the ‘17+1’ group in 2019 (the 17 countries from central and eastern Europe with whom Beijing has sought greater economic partnership), according to fDi Markets. Chinese FDI has been directed mainly towards Serbia’s export-oriented manufacturing areas, such as steel and copper production, as well as key infrastructural projects, all of which are areas of Chinese expertise, says NBS.

The EU has voiced concern about China’s reach, investment and level of lending in the Balkans region. But Mr Čadež does not see this is as a problem for Serbia. “Why should Serbia’s increasingly attractive environment for Europeans, Americans, Russians and the Chinese be an obstacle to EU integration. Why would this be a problem for Serbia while the EU [does far more trade and investment with China]?” he says.

Stability and subsidies

On top of strong macroeconomic indicators, foreign investors are finding that Serbia presents a compelling range of pull factors. “According to numerous contacts with foreign investors, the first of Serbia’s attractions is stability. Since 2012, Serbia has achieved and maintained full price stability, relative exchange rate stability and financial stability, as well as political stability,” an NBS spokesperson tells fDi.

“Foreign investors find some of [Europe’s] lowest operating costs, as well as tax and customs benefits, government subsidies and local self-government incentives. For example, [some] are exempted from paying income taxes for 10 years, can import equipment without any customs or other duties, and can enjoy the benefits of agreements for avoiding double taxation with 59 countries,” says Mr Čadež.

Such benefits can be found within Serbia’s 15 free economic zones, with capital- and headcount-heavy investments also qualifying for government subsidies. Serbia's human resources are also advantageous: besides its high levels of English speakers, Serbia ranks 27th out of 157 countries in the World Bank’s Human Capital Index, the highest in the Balkan region.

Risks remain

The NBS’s record high gross and net foreign exchange reserves provide a buffer in the case of external shocks. However, some risks remain for foreign companies, such as competition policy, which sometimes favours incumbent state-owned operators, according to Peter Tabak, western Balkans regional economist at the EBRD.

Foreign investors are also concerned about certain constraints on currency controls, while intrusive inspections and long waits at certain borders could also use more attention, he adds.

Serbia has attracted more than half of the western Balkans’ total foreign investment inflows over the past 10 years, according to the IMF, but many in the country claim it would benefit from increased economic integration between the six countries. Modest progress has been made towards achieving the Western Balkans Economic Area, a mini customs union and single market with some level of freedom of movement. This would accelerate EU integration and precipitate some much-needed political reconciliation between certain Balkan states.

Costs of this report were underwritten by the following sponsors: Ministry of Finance of Serbia, the Chamber of Commerce and Industry of Serbia, the Free Zones Administration of Serbia, Free Zone Subotica, Free Zone Svilajnac, Free Zone Uzice, Free Zone Priboj and Free Zone Smederevo. Reporting and editing were carried out independently by fDi Magazine.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.