Chinese investment to Europe at record high

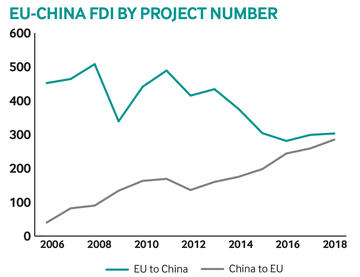

Sino-European foreign direct investment is converging, according to data from fDi Markets.

The number of greenfield foreign investment projects from China to Europe has grown non-stop since 2012 and very strongly since 2016, while capital expenditure has also shown a decisively upward trend, according to fDi Markets.

In fact, Chinese foreign investment in Europe hit a record high in 2019 of $18.8bn, despite incomplete fDi Markets data, while the previous year saw a record number of Chinese FDI projects, with 285.

Conversely, the number of greenfield foreign investment projects from Europe to China has fallen almost uninterrupted since 2012, shows fDi Markets.

A recent study published in the Swedish press revealed the extent of Chinese involvement in the country’s economy. Sixty-five major businesses were either completely or partially acquired by China based firms between 2002 and 2019, with Chinese investment for these years totalling $11bn. This includes well-known international companies such as Spotify, Volvo and Acne.

This FDI trend is nothing new. In 2018, Bloomberg published a report entitled ‘How China is buying its way into Europe’, in which the company revealed that since 2008, Chinese companies had invested a staggering $318bn in European businesses, with 360 companies having been purchased by Chinese investors.

This includes four airports, six seaports and 13 professional football teams. More than half of these investments, however, are concentrated in Europe’s five largest economies: Germany, the UK, Spain, France and Italy. While this might be a trend welcomed by some, concerns have been raised over how this increased presence might jeopardise national security.

This partially explains the urgency with which French president Emmanuel Macron and German chancellor Angela Merkel have been pushing for the recently confirmed EU investment screening mechanism, a non-binding agreement that targets foreign acquisitions in sensitive technologies and infrastructures.

Addressing this disproportionate rise in Chinese investment, Ms Merkel told the German parliament two months ago that she will make EU-China relations a priority at the upcoming summit in Leipzig, a conference due to be held between the two blocs in September 2020. This includes hopes of signing off on an investment deal under which European companies will be allowed greater access to the Chinese market.

Even though Chinese president Xi Jinping has in the past shown reluctance to compromise, Chinese State Television reported recently that during a telephone conversation with his newly elected European Council counterpart Charles Michel, he had expressed renewed willingness to co-operate on an agreement that would lead to a more balanced investment relationship.

Positive steps have already been made, with China last year liberalising its foreign investment climate to provide better legal protection to foreign investors, EU or not.

However, for a more balanced relationship, the EU needs to agree on a unified approach to its China policy, something that has been a struggle in the past. While there have been improvements in recent months, with member states endorsing Brussels’ ‘EU-China Strategic Outlook’, a strategy which includes the enhanced screening on foreign investments, countries such as Hungary and Greece still refuse to endorse any statements by the EU criticising the Chinese government.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.