fDi Renewable Energy Investments of the Year 2019 - the winners

Asia-Pacific is the leading destination for greenfield FDI in renewable energy, while the US is the top country, Dubai the top city, Germany the top source of investment, and Enel Green Power and Canadian Solar the most active investors. Sebastian Shehadi examines the results of fDi’s first Renewable Energy FDI Rankings.

Renewable energy (excluding hydro energy) is the world’s third biggest industry for greenfield FDI attraction, garnering $307bn and 1417 projects between December 2013 and November 2018, according to greenfield investment monitor fDi Markets. Only the real estate and coal, oil and gas sectors are bigger. Renewable energy investments tend to be large in size, with an average capital investment of $217m.

Download a PDF of these rankings here:

Regionally, the top source of investment is, by far, western Europe with 790 projects, followed by Asia-Pacific’s 311. The dominance of Western European FDI into renewables is underlined by the fact that Germany and Italy are the world’s top two sources of investment, and that three other Western European countries feature in the top 10. The US and China are the other notable players, taking third and fifth place, respectively.

In terms of destination for investments, the Asia-Pacific region has attracted the majority of FDI projects in renewables with 454, followed by Western Europe with 276. At a country level, the US and the UK have led the charge, accompanied by no fewer than six emerging markets in the top 10: Mexico, India, Chile, Brazil, Vietnam and the Philippines. Indeed, developing economies have received the lion’s share of greenfield FDI in renewables, attracting nearly 70% of all FDI projects.

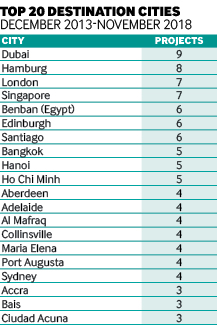

Among cities, Dubai has attracted the most projects, followed by Hamburg and London. The most active investing companies are Italy’s Enel Green Power (EGP) and Canadian Solar, with 27 FDI projects each, followed by Canada’s Sky Power and Spain’s Acciona Energia.

Winds of change

At first sight, it may seem concerning that greenfield FDI into renewables has remained steady since 2007, with no major increases. However, this is no surprise.

“We are doing more with less. The unit cost of the technology of wind and solar has been declining steadily, annually. So if you look at the graph of installed capacity, not investments, you will see growth,” says EGP chief executive Antonio Cammisecra.

Further reading

Indeed, global clean energy investment dropped by 8% in 2018, hitting $332.1bn, according to recent figures from Bloomberg NEF. However, the report found that globally the number of new solar and winds projects still increased due to significant cuts in the cost of solar and wind energy.

Policy matters

Last year’s largest decrease in renewable energy investment occurred in China, as a result of a government policy that withdrew subsidies for solar projects from June, according to BloombergNEF.

Similarly, greenfield FDI into European renewables has significantly dropped since 2013 due to the reductions of feed-in tariff policies, and because many EU countries have achieved the first tranche of EU objectives for 2020, according to Mr Cammisecra.

Feed-in tariffs are designed to increase investment in renewables by offering long-term contracts and price-based support to renewable energy producers, such as financial guarantees for every unit of electricity that is produced, usually over a period of 15 to 20 years.

“The tariffs have been very effective, especially in Germany,” says Anders Wijkman, vice-president of internationalist organisation the Club of Rome. “Some people criticised them for being too high, and too beneficial for the investor, while imposing too high a cost on society. That could be true. The government has now reduced tariffs a bit. They have been very positive in terms of bringing costs down for both wind and solar.”

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.