Mexico leads automotive FDI ranking

The usual names dominate fDi's automotive ranking, with Mexico, the US, China, Spain and India leading the way. However, the likes of Hungary, Slovenia and Morocco have made headway in the chasing pack. By Sebastian Shehadi

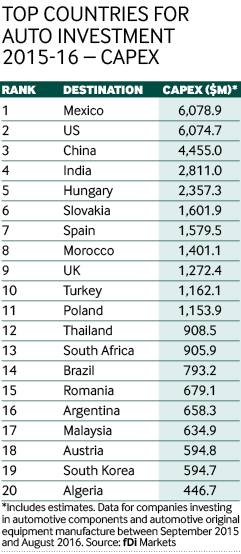

Given their reputations as powerhouses of the auto industry, it is no surprise that Mexico, the US, China, Spain and India have attracted the most FDI in terms of capital investment, from automotive original equipment manufactures (OEMs) and automotive component suppliers over the past year. Rubbing shoulders with them, however, are Hungary, Slovakia and Morocco, who last year ranked outside the top 15.

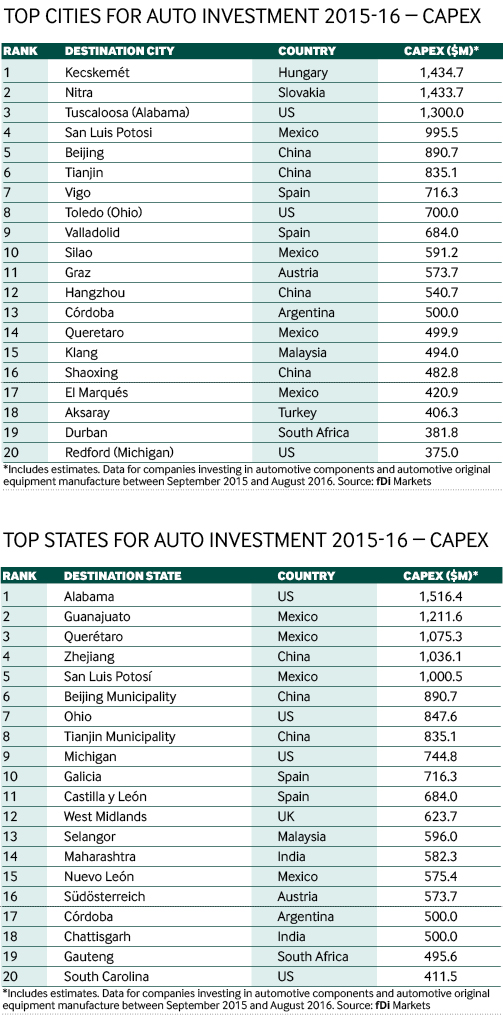

According to greenfield investment monitor fDi Markets, Hungary’s Kecskemét and Slovakia’s Nitra are the top cities for FDI, each attracting roughly $1.4bn from automotive OEMs and suppliers between September 2015 and August 2016. Hot in pursuit is Mexico’s San Luis Potosi and Tuscaloosa in Alabama.

Indeed, Alabama is this year’s top state for FDI in the sector, attracting $1.5bn. In the past 18 months, Alabama has witnessed a flurry of automotive growth from, for example, Honda and Hyundai. Mercedes is six months away from completing its $1.3bn, 300-job expansion in the state, according to USA Today.

Following Alabama in second place is the Mexican state of Guanajuato, while China’s big hitter, Zhejiang, comes fourth. As is the case with the top 20 cities for automotive FDI, the top 20 states are predominantly Chinese, Mexican and American. Correspondingly, Mexico is this year’s top country after attracting $6m, followed closely by the US and China.

OEM leaders

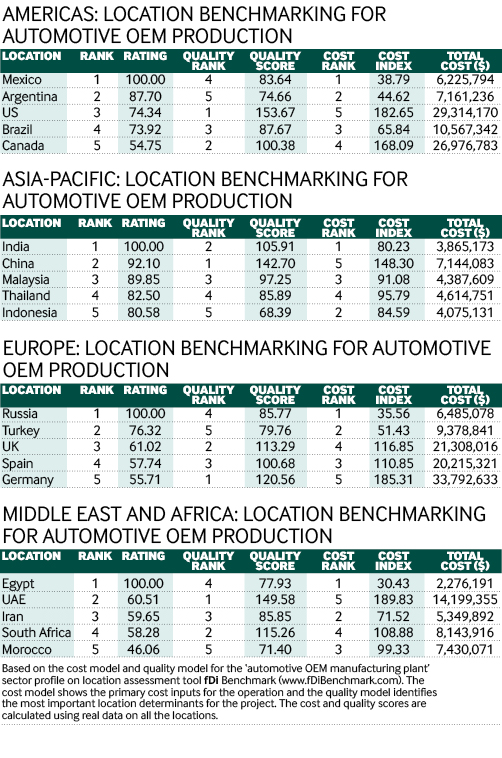

fDi Benchmark, an analytics service affiliated with fDi Magazine, ranked this year’s best countries for automotive OEM production, based on lowest cost and best quality. In the Americas, Mexico has taken first place, despite ranking fourth for its quality. Following Argentina in second place overall is the US with the best quality cars (the US ranks number one globally for quality) but its high production costs drag it down the regional ranking.

In the Middle East and Africa, Egypt takes first place thanks to its production costs – one of the lowest in the world. Conversely, the United Arab Emirates takes the regional second place due to its exceptional quality – ranking amongst the best globally – but its car production is among the world’s most expensive.

Thanks mainly to their low costs of production, Russia and Turkey take first and second place, respectively, for Europe. The UK, Spain and Germany follow, albeit with considerably higher quality scores but more expensive production. Germany’s cost index is particularly high.

In Asia-Pacific, India and China are a respective first and second. Unlike other regional winners, India has struck a decent balance between quality and cost. As with other more developed economies, Chinese automotive production is costly but high in quality.

Overall, North America and western Europe have the most expensive automotive OEM production in terms of total cost, and the highest levels of quality.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.