India has emerged as the destination of choice for foreign direct investment by Chinese tech firms as the Asian superpowers strengthen relations, although New Delhi’s new rules on “opportunistic takeovers” by neighbouring countries may limit the growth of the trend.

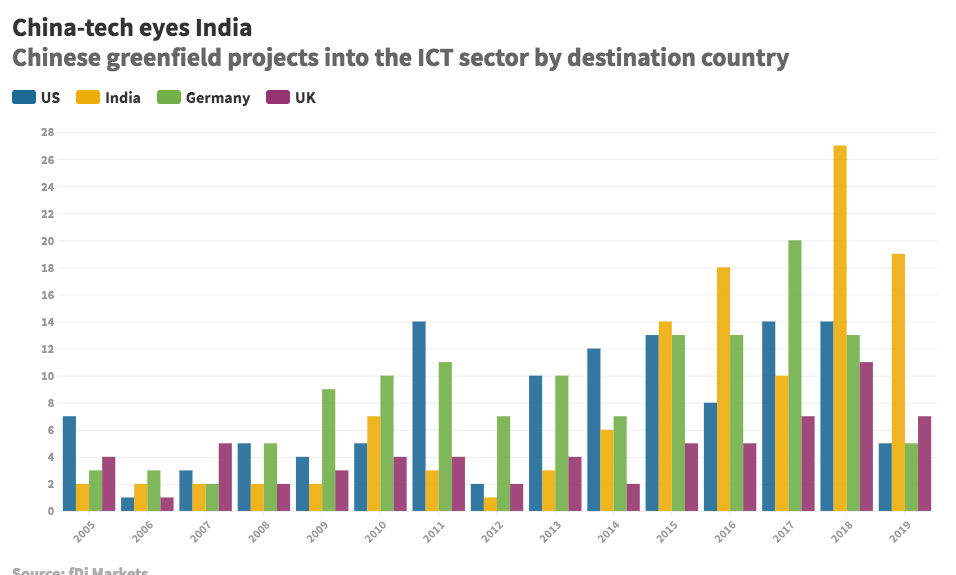

China sourced 35 projects in India’s IT and electronics sector in the 12 years between 2003 to 2015, but over the next four-year period between 2015 to 2019, this number jumped to 88 projects, according to the FT’s foreign investment monitor fDi Markets.

Advertisement

India was the main destination for Chinese foreign investment in the IT and electronics sector last year with 19 inbound projects, which is more than double the eight projects invested in Russia, the second-highest destination for investment, according to fDi Markets. Typical recipients of Chinese FDI into the IT and electronics sectors like the US and Germany lagged further behind with, respectively, seven and five projects each during the period.

Among others, Salcomp, a developer and manufacturer of power supplies and a subsidiary of China-based Lingyi iTech, announced the opening of a new manufacturing facility in Chennai, India in November 2019. The $279.4m investment is to produce mobile chargers and smartphone components, primarily for export markets.

China’s investment into India’s tech scene extends beyond FDI, as large firms from its private sector have increased acquisition of minority or controlling stakes in Indian companies.

Led by tech giants Baidu, Alibaba and Tencent, Chinese investments in Indian start-ups increased five-fold to $5.6 billion in 2018, up from $668m in 2016, according to data from Tracxn.

Tencent and Alibaba have acquired diversified portfolios in India, ranging from Alibaba’s $216m investment in online grocer BigBasket and $210m investment in food delivery app Zomato, to Tencent’s $400 million investment in ride-hailing app Ola. Tencent also invested $700m in e-commerce platform Flipkart in April 2017 as part of a deal which broke the record for most money raised by an India company.

New takeover rules

Advertisement

However, new rules on “opportunistic takeovers” by neighbouring countries approved by the Indian government approved on April 18 is likely to slow the trend in the medium term. Government approval is now mandatory for any merger and acquisition (M&A) involving any entity based in or tied to a country which shares a land border with India as the Covid-19 crisis slashes the valuations of Indian companies across the board.

India has overtaken the United States as China’s main destination market for IT and tech investments. The number of Chinese greenfield investments in the US’s IT & Electronics sector hit a 7-year low in 2019. During the first half of this seven-year period (January 2013 to June 2016), China invested 40 projects into the US and 32 into India in the IT sector. In the second half of this seven-year period, (July 2016 to December 2019), Chinese investments into India more than doubled to 65 in the sector, whereas projects into the US decreased to 36.

Overall investment (greenfield and M&A) from China into India doubled in 2019, according to figures from merchant bank Grisons Peak.

Chinese President Xi Jinping recently offered Indian leader Narendra Modi the opportunity to participate in a 100-year joint strategic plan, according to Henry Tillman, chairman of China Invest Research, the Chinese macro research arm of Grisons Peak. “India’s historical innovation in IT and pharmaceuticals continues to attract increasing Chinese investment,” he explained.