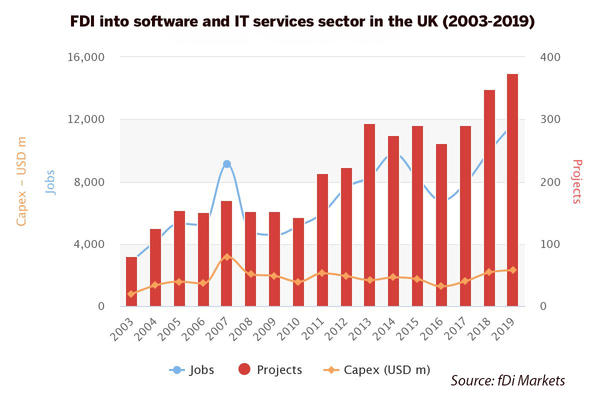

Foreign direct investment into the British software and IT services sector steadily increased in the four-year period after the Brexit referendum despite the economic uncertainty that followed the controversial vote.

Tech investment into the UK rose year-on-year between 2016 and 2019, reaching an all-time high of 374 new projects creating 11,702 jobs last year, according to greenfield investment monitor fDi Markets.

Advertisement

The $2.3bn invested in the sector in 2019 was the second-highest annual figure since 2003, when fDi Markets started compiling data (behind $3.1bn in 2007).

During the four-year period key metrics increased: from 262 projects with $1.2bn FDI generating 6,793 new jobs in 2016; to 290 projects with $1.6bn investment creating 7,893 new jobs in 2017; to 348 projects with $2.1bn FDI spawning 9,943 new jobs in 2018, before reaching the all-time highs of 2019.

Belfast benefits

Between January 2016 and December 2019, London was the most popular city for software and IT Services FDI in the UK, followed by Belfast and Manchester.

Belfast saw a steady rise in new tech jobs, with 895 positions created in 2016 and 743 added in 2017. In 2018, 1,010 new jobs were created in the northern Irish capital, representing more than 10% of the total jobs created in the software and IT services sector in the UK that year.

Manchester saw eight new projects created in 2016, with a slight dip to six new projects created in 2017. The city experienced a steady increase in new projects thereafter, with nine projects added in the sector in 2018 followed by 12 new projects in 2019.

Advertisement

Of the 1,274 software and IT Services projects created in the UK between 2016 and 2019, 13.5% were the establishment of a headquarters.

The majority of the investment came from the US, which was behind 43.25% of projects. US tech giant Amazon created eight software and IT services projects in the period between 2016 and 2019, all for research and development activities.

Covid drop-off on cards

Big technology companies are expected to emerge from the coronavirus pandemic in an even stronger position because of increased demand for digital solutions and software services.

However, early indications are that FDI into the British tech industry may fall this year as a result of the crisis. fDi Markets data for the first quarter of 2020 shows a decrease in project numbers of more than 50% in comparison to the same period last year as Covid-19 takes its toll on FDI activity in the industry.