Expectations for Joe Biden to roll back some of the most iconic rollbacks of his predecessor, Donald Trump, are sky-high as he assumes office on January 20 2021.

Mr Biden has made it clear that he will not hesitate in wiping Trump’s legacy on several of the burning issues in the global economic development agenda, although there will be elements of continuity, too.

Advertisement

Here are five charts to help understand some of the key challenges, and opportunities, that lie ahead for the new US president.

Climate change

The US renewable energy industry has been flourishing in recent years, despite Trump’s disregard for climate change and open support for fossil fuels. Mr Biden’s climate change agenda, the US’s most ambitious to-date, is tipped to be a new boon for both the country’s quickly growing renewable energy industry and its European investors who have been waiting in the wings.

Mr Biden has pledged to “reverse all the damage Trump has done” and will start by rejoining the Paris Climate Accord on his first day in office. He has even appointed one of the pact’s architects — former secretary of state John Kerry — to the recently elevated role of US climate envoy. The government plans to fund $2tn of climate-related investment during its first term, and entice around $3tn of private and state-level investment over the next decade.

Investment scrutiny

Chinese investment into the US has been plummeting as scrutiny and political backlash has increased. This intense scrutiny is expected to continue under Joe Biden's incoming administration. However, Mr Biden’s multilateral approach has buoyed hopes that investors from US allies are less likely to be caught in the crosshairs.

Advertisement

“I’d expect less of a push for reviews on companies from allied countries, and I suspect the ‘white list’ of countries — which are exempted from some of the more restrictive requirements — will probably be expanded,” says Martin Chorzempa, a research fellow at the Peterson Institute for International Economics who studies the Committee on Foreign Investment in the United States.

Chinese investment

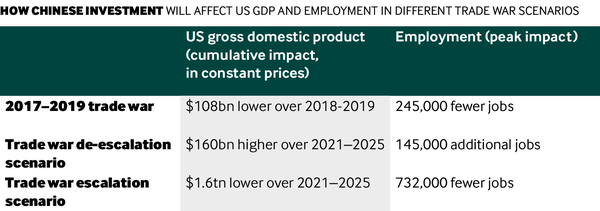

Chinese investment is not only a matter of national security, but also of jobs security. Economic projections show that protracted trade tensions with China will cost the US economy hundreds of thousands of jobs.

“In addition to showing that tariffs raised so far have been harmful to the US economy, our forward-looking scenario analysis shows that scaling back tariffs would benefit US employment and household incomes. On the other hand, if economic tensions were to increase further, it would harm the American economy and reduce employment,” a report by research firm Oxford Economics and the US–China Business Council concludes.

CPTPP

It’s no secret that the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) would finally live up to the expectations of the trade pact’s ill-fated predecessor, the TPP, should the US join in. But domestic divisions and other signatories’ unwillingness to bend to US demands create an uphill battle for president-elect Joe Biden.

The original pact faced heavy criticism in the US from the likes of trade unions fearing job losses to lower-cost jurisdictions and businesses worried about competing with cheap imports. “The rhetoric in the US was that TPP was the latest in a series of deals that served corporate interests and sold out working people,” notes Edward Alden, a senior fellow at the Council on Foreign Relations.

The recession and discontent following the US election mean pushback today would likely be just as strong. Mr Biden’s pledge to prioritise domestic issues may delay his re-engagement with the CPTPP — which lowers tariffs and other barriers to trade and investment among member countries — but it could boost success in the long-term. “If we can address a lot of these economic anxieties, economic equalities and other concerns through domestic measures, that takes pressure off trade agreements,” says Ms Cutler.

Iran

Foreign investment into Iran has rapidly collapsed with the rise of Mr Trump, and his commitment to enforce a widening pool of sanctions on US and international investors alike. Mr Biden has signalled he is willing to rejig the Joint Comprehensive Plan of Action (JCPOA) signed by Iran and the P5+1 bloc (China, France, Russia, the UK and the US, plus Germany) in 2015.

“The mechanics and sequencing of an American re-entry into the JCPOA remain to be determined, but it will not be harder than when the deal was originally struck, when taboos needed to be broken in Tehran and Washington,” Esfandyar Batmanghelidj, founder and publisher of Bourse & Bazaar, a media company that supports business diplomacy between Europe and Iran, says.

The road ahead remains uphill though, as domestic opposition — as well as social and economic turbulence — will hit the level of priority of the Iran dossier on Biden’s table.