fDi Reinvestment Ranking 2017: Singapore takes top spot

An assessment of FDI expansions reveals which locations enjoy the most follow-up investments and why. Cathy Mullan analyses the results.

What keeps an investor coming back for more? What drives them to follow up an initial investment with more capital and to root their operation to a location more firmly? Of all reinvestment projects recorded between January 2006 and October 2016 recorded by greenfield investment monitor fDi Markets, one-quarter cited the growth potential of the locations as the primary influence behind the decision. The availability of a skilled workforce and proximity to markets and customers were also key factors for investors, accounting for 18.5% and 13.5% of all companies’ motives, respectively.

To download a PDF of this report click here:

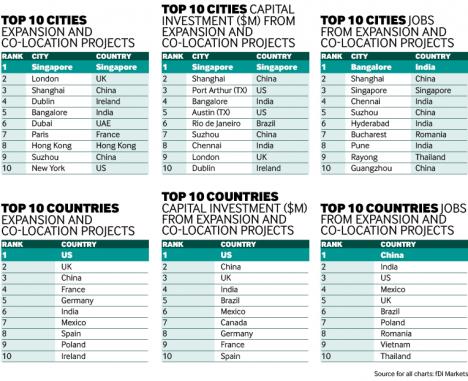

Singapore, a global financial hub and foreign investment titan, attracted the highest number of expansion projects of all locations globally: recording 462 between January 2006 and October 2016. The city-state offers investors a central location and easy access to the Asian market, strengthened by regular appearances in global rankings as a top destination for doing business. Singapore ranked second in the Global Talent Competitiveness Index 2017 from Insead, which measures places’ ability to enable, attract and retain staff. This is testament to the level of skill in the city’s workforce. US-based audio electronics development company Harman International Industries established its Asia-Pacific headquarters in Singapore in June 2016, citing the city’s international and local talent as a motive for its investment decision.

The highest number of Singapore’s expansion projects were in the chemicals sector, in which 54 projects were recorded, closely followed by software and IT (51) and business services (42). Reinvestments came from major companies including US-based oil and gas company Exxonmobil, which expanded in Singapore on seven occasions during the time period, creating more than 6000 jobs. The city attracted the highest level of capital investment, with an estimated $29.7bn invested in the expansion of existing facilities by foreign companies.

London still booming

UK capital London ranked in second place for reinvestment projects, attracting 356 investments from 326 companies. Nearly 30% of all expansions in London were in software and IT, followed by financial services (21.1%) and business services (19.9%). In May 2016, US-based Capital One Financial Corporation expanded its software centre in the city, citing the technological expertise available around Silicon Roundabout, a tech cluster located in the east of the city.

The number of software reinvestments in London increased fairly steadily between January 2006 and October 2016. Expansion projects have come from US-based software giants in recent years: social media company Facebook has expanded its operations in the city four times (including doubling the size of its UK headquarters), IBM three times and online retailer Amazon twice.

Bangalore, in India’s Karnataka state, topped the ranking of locations for job creation from reinvestments. More than 60% of the jobs created from expansion projects in the city were in R&D operations, testament to the city’s reputation as a research hub, which dates back to the establishment of the Indian Space Research Organisation in the 1970s. China-based Huawei Technologies increased its employee headcount to 7000 over the five-year period to 2015, while in September 2016 Germany-based Bosch announced a $55.9m investment to expand its research centre in the city, creating 3000 jobs.

Methodology

To compile the results for this ranking, fDi Intelligence, a data division of the Financial Times, looked at the FDI data between January 2006 and October 2016. Data was drawn from fDi Markets, a crossborder investment monitor, and includes strictly greenfield investment. Locations were ranked on their record of attracting expansion and co-location projects. Data included locations globally and projects in all sectors.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.