Singapore retains FDI reinvestment crown

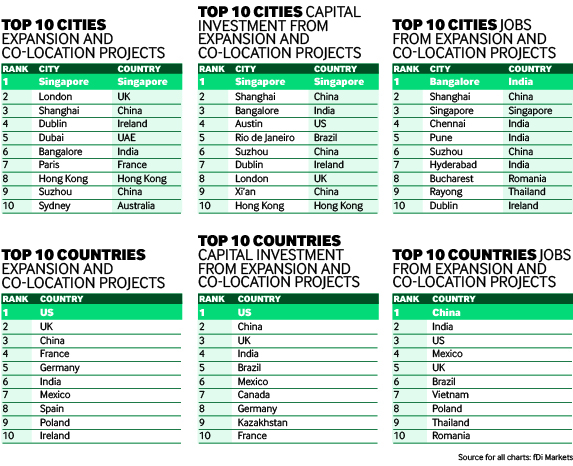

Singapore is again the lead city in fDi's ranking assessing reinvestment levels, with London second and Bangalore third. Naomi Davies looks at the results.

With so much focus on companies expanding into new markets, it is often easy to overlook the locations that enjoy the most reinvestment and the reasons why businesses continue to build up operations in a certain location. According to investor motives recorded by crossborder investment monitor fDi Markets, 37.3% of companies that gave a reason for their reinvestment were motivated by a location’s growth potential, 30.5% by a skilled workforce and 21.1% by proximity to markets.

Singapore is the standout performer when it comes to reinvestment for a second year in a row, recording the most expansion and colocation projects (478) between November 2007 and October 2017. The highest number of projects recorded was in the software and IT sector (57), closely followed by chemicals (56) and business services (44). The city-state also attracted the highest level of capital investment, with an estimated $29.9bn reinvested by foreign companies in their existing facilities over the past decade. So what is it about Singapore that keeps investors returning time and again?

When US-based power management company Eaton expanded its east Asian headquarters in Singapore in August 2017, chief operating officer Revathi Advaithi said: “The country’s business-friendly environment and drive for innovation provide a strategic backdrop for investment and growth, both locally and in the wider Association of South-east Asian Nations region.”

In addition, Singapore has a high concentration of industry-leading companies as well as excellent transportation links, outstanding universities and an educated workforce that has a strong reputation when it comes to technology and innovation. The city ranked second in the World Bank’s Doing Business 2018 report and third in the 2018 Bloomberg Innovation Index, up from sixth place in 2017.

Major companies continue to reinvest in Singapore, including US-based data centre provider Equinix, which has expanded its operations in the city six times since November 2007, and US-based oil and gas giant ExxonMobil, which has created an estimated 6000 jobs there during the same period.

Brushing off Brexit?

In the year following the Brexit referendum, London has held on to second place for reinvestment projects, attracting 413 investments. The UK capital reinforced its position as a tech hub with nearly one-third of its total expansion projects in the software and IT sector, followed by financial services (20.8%) and business services (19.4%). In October 2016, when Netherlands-based bank ING announced plans to expand its office in London, head of financial markets Percy Rueber said: “Following the Brexit vote, the intention to move some functions to London might seem countercyclical. However, even after Brexit, London has and will continue to have a deep labour talent pool to support our business.”

Another notable reinvestor is Netherlands-based computer data storage services company Interxion. It has expanded its London operations five times since November 2007 – most recently in February 2017 when it announced plans to open a third data centre at its Brick Lane campus.

Bangalore does the job

Bangalore, dubbed the ‘Silicon Valley of India’, comes out on top for job creation from reinvestments, with an estimated total of almost 80,000 jobs created between November 2007 and October 2017. UK-based Quanticate, a data-focused clinical research organisation, expanded its office in the city in September 2017, citing the extensive talent pool as its reason for reinvestment.

Bangalore’s reputation as an IT hub is further reflected in the types of companies that continue to invest in the city, with China-based Huawei Technologies, a leading telecommunications solutions provider, coming in first place by creating an estimated 6642 jobs, followed by Daimler (5370), General Electric (5369) and Robert Bosch (3558).

Methodology

To compile the results for this ranking, fDi Intelligence, a data division of the Financial Times, looked at the FDI data between November 2007 and October 2017. Locations were ranked on their record of attracting expansion and co-location projects. Data included locations globally and projects in all sectors.

Click on the link below for a PDF version of the complete results:

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.